-

SEARCH

Type your search in the field above

Lerøy Seafood Group's strategy during the last thirty years has been to build an integrated value chain. At the heart of the strategy is the belief that integrated value chains are essential to meeting the customers' demands for traceability, product development, sustainability, food safety and efficiency.

For Lerøy Seafood Group as a corporation, maintaining a constant focus on areas where we have the greatest influence in terms of sustainability is essential.

Based on a critical evaluation of the value chain and our processes, we have defined the following strategic and sustainability-related focus areas:

Safety first - we priroritise the well-being of our employees by actively preventing accidents and risks.

Develop our people - employees who perform well in a safe and development oriented work environment are a key aspect to continuous improvement, generation of innovative ideas that support learning and development.

Lerøy Way - is the Group's working method. The core principle of this method is to use established principles and build a culture of continuous improvement.

Reduce our footprint - we prioritise minimising our environmental impact by focusing on reducing footprint throughout our value chain.

Strengthen our reputation and regulations - to achieve Lerøy's primary goal of creating the world's most efficient and sustainable seafood value chain, we need reliable and predictable regulations.

Vision for the Group

«We shall be the leading and most profitable global supplier of sustainable high-quality seafood.»

We depend on the ocean's bounty and rely on the sustainable management of its resources. This enables us to produce and sell quality seafood in the future. Through close cooperation with professional bodies, customers, and suppliers, we will deliver a safe working environment, high professional competence, the right quality, and sustainable solutions throughout the value chain.

The values of the Group are:

Mission

“Take action today for a difference tomorrow”

Pursuant to section 6-41 (1) of the Norwegian Public Limited Liability Companies Act, companies listed on the Oslo Stock Exchange are obliged to establish an Audit Committee that prepares matters for and advises the Board of Directors.

In 2024, Lerøy Seafood Group’s Audit Committee consisted of Britt Kathrine Drivenes and Didrik Munch (chairperson). In February 2025, the Board decided to expand the Audit Committee to include Karoline Møgster. The Audit Committee reports to the Chair of the Board. It conducts quality assurance for internal control and reporting. It is also responsible for the Board of Directors’ dialogue with and monitoring of the external auditor. The auditor reports on their work in writing to the company administration and the Board through the Audit Committee. The Audit Committee held thirteen meetings during 2024.

Pursuant to Article 5, paragraph 2 of the Company’s Articles of Association, the Company shall have a Nomination Committee consisting of three members elected by the annual general meeting for a period of two years. The Group’s Nomination Committee is in charge of preparing proposals for the composition of a shareholder -elected Board of Directors and with submitting recommendations to the annual general meeting for appointments to the Board.

At present, the members of the Nomination Committee are Helge Singelstad (Chairperson), Benedicte Schilbred Fasmer, and Morten Borge. Lerøy Seafood Group has not established specific guidelines for the Nomination Committee. However, the composition of the Nomination Committee is such that the interests of the shareholders in general are taken into account in that the majority of the committee is independent of the Board and other executive personnel, and the company’s Articles of Association also specify the framework for the Committee’s work. No Board members or executive personnel in the company are members of the Nomination Committee.

The Nomination Committee makes a recommendation regarding remuneration to the members of the Board. The general meeting makes the final decision regarding remuneration to be paid to the members of the Company’s Board and Nomination Committee.

Information on the members of the Nomination Committee is published at leroyseafood.com. To ensure the best possible basis for their assessments, the Nomination Committee will hold individual conversations with Board members and with the CEO. There is also provision for the Nomination Committee to have contact with the shareholders when recommending candidates and for shareholders to recommend candidates to the committee.

The reasoned recommendation of the Nomination Committee is included in the supporting documentation for the annual general meeting, which is published within the twenty- one- day deadline for notice of the general meeting.

In the first quarter of 2024, the Board established a Remuneration Committee consisting of the Chair of the Board and board member Are Dragesund to ensure the remuneration policy in the Group aligns with the Company’s long-term interests and strategy. The Remuneration Committee will, among other tasks, update the Group’s guidelines for stipulating salaries and other remuneration of persons in senior positions.

Chair of the Board Arne Møgster (He/him) (1975) was elected to the board at the annual general meeting on 26 May 2009. He holds a Master of Science (MSc) in International Shipping and a Bachelor degree in Business and Administration.

Arne Møgster is the CEO of Austevoll Seafoood AS, and a board member for a number of companies in the Austevoll Seafood Group. Prior to joining Austevoll Seafood ASA in 2006 - Arne Møgster earned himself versatile experience working within fishing, shipbuilding and the offshore supply market. He was the Managing Director of Norskan AS for 3 years, with one year based in Brazil.

Through his position as CEO and board member in listed companies for more than a decade Arne has extensive knowledge of a broad range of subjects including wide experience in working with ESG.

Austevoll Seafood is the majority owner in Lerøy Seafood Group, and the majority owner in Austevoll Seafood is Laco AS. Arne Møgster is a shareholder in Laco AS, and indirectly holds shares in Lerøy Seafood Group ASA.

Board memeber - Linda Kidøy Pedersen (She/her) was elected to the board on the 28th of May 2024. She holds a Cand. Scient degree in organic chemistry (1996) from the University of Bergen.

Linda has experience in areas such as nutrition and microbiology, as well as management in quality and laboratory work. Currently, Linda is the factory manager at O. Kavli AS and has extensive experience in the production of consumer goods, emergency management, and food safety.

Linda Kidøy Pedersen does not own shares in Lerøy Seafood Group as of 31 December 2024.

Board member Didrik Munch (He/him) (1956) was elected to the Board at the Annual General Meeting on 23 May 2012. He has a law degree from the University of Bergen. Didrik qualified as a police officer at the Norwegian Police University College in Oslo and held a number of positions within the Norwegian police force (1977–1986). From 1986 to 1997, he worked in finance, primarily in the DnB bank system, where he eventually joined corporate management as Director for the DnB Corporate Customer division. From 1997 to 2008, Didrik was the CEO of Bergens Tidende AS. He was CEO of Schibsted Norge AS (formerly Media Norge AS) from 2008 to 2018 and is currently self-employed. Didrik Munch has served on the boards of a number of companies, both as chair and an ordinary member. He is currently Board Chair of Solstrand Fjordhotell Holding AS and NWT Media AS, and serves on the boards of Grieg Maritime Group AS, SH Holding AS and Jonstadveien 6 AS.

Didrik Munch currently chairs the Audit Committee of Lerøy Seafood Group ASA. He also has comprehensive knowledge within the field of ESG through his extensive experience from the managements and boards of some of Norway’s largest companies. Didrik Munch is an independent director. As of 31 December 2024, he owned no shares in the company.

Board member Britt Kathrine Drivenes (She/her) (1963) was elected to the Board at the Annual General Meeting on 20 May 2008. She holds a Bachelor of Management and a Master of Management Programme in Internal audit, Risk Management and Corporate Governance from the Norwegian School of Management (BI) and a Master of Strategy and Management from the Norwegian School of Economics (NHH). She is the CFO of Austevoll Seafood ASA and also serves on the boards of several companies in the Austevoll Seafood Group. She has also been part of the Board in Norwegian Seafood Research Fund, FHF – since 2019. FHF’s goal is to create added value to the Seafood industry through industry based research and development. Britt Kathrine Drivenes has extensive experience from the fishing industry as well as financing, accounting and ESG. She is the board's designated resource related to ESG, and has completed The Acadamy for Sustainability Reporting, by The Norwegian Institute of Public Accountants. She has previously served as as board member in an IT company, and has knowledge within IT and cybersecurity. She owns shares indirectly in Lerøy Seafood Group ASA as a shareholder in Austevoll Seafood ASA.

Board member Karoline Møgster (She/her) (1980) was elected to the Board at the annual general meeting on 23 May 2017. She has a law degree from the University of Bergen (Candidata juris). She also has a Master of Science in Accounting and Auditing (MRR) from the Norwegian School of Economics. She has previously worked as a lawyer with Advokatfirmaet Thommessen AS and is now employed as a lawyer in Møgster Management AS in the Laco Group.

Karoline has extensive experience within Corporate Governance and corporate law as well as accounting and financing. She has also completed The Academy for Sustainability Reporting, by The Norwegian Institute of Public Accountants.

Karoline serves on the board of Laco AS and has board experience from other listed companies. Laco AS is the ultimate parent company of Lerøy Seafood Group. She is also a board member in Fiskebåt Sør.

Karoline Møgster indirectly owns shares in Lerøy Seafood Group ASA as a shareholder of Laco AS.

Board member Are Dragesund (He/him) (1975) is an investment professional and co-head of Ferd Capital at Ferd AS, one of Norway’s largest family-owned investment companies. Prior to joining Ferd in 2015, Are worked at The Norwegian Ministry of Finance, Cardo Partners and The Boston Consulting Group. He is a Norwegian national and graduated from the Norwegian School of Economics (NHH) in 2000. From his career as management consultant and investment professional, Are has extensive experience from the consumer goods and maritime industries. His core competencies are within strategy, finance, M&A and capital markets. As a former board member of IT security specialist firm Mnemonic AS, Are has a good command of IT security. In addition to Lerøy Seafood Group ASA, Are currently serves on the boards of Nilfisk AS, Mestergruppen AS and Brav AS. He has previously served on the board of Norkart AS. Are is an independent member of the board. As at 31 December 2022, Are Dragesund owned no shares in the company.

Board member Silje Elin Butt (She/her) (1984) was elected to the company's board as an employee representative in 2024. Silje holds a Bachelor's degree from BI Norwegian Business School and began her career as a trainee at Hallvard Lerøy in 2007. In recent years, she has supplemented her education with relevant courses at BI and internally at Lerøy, including the "Leader in Lerøy" program. After 16 years of selling seafood to the European market, Silje is currently the team leader for the Internal Sourcing team at Lerøy Seafood.

As of 31 December 2024, Silje Elin Butt owned no shares in the company.

Board member Bjarne Kristiansen (He/him) (1955) was elected to the company's board as an employee representative in 2024. Bjarne is the group union representative at Lerøy Norway Seafood.

He has been a union representative since 1990 and has been a full-time group union representative since 1996. Bjarne has served as an employee representative on the board of Lerøy Norway Seafood continuously since 1997. He has worked in the fishing industry since 1973. As of 31 December 2024, Bjarne Kristiansen owned no shares in the company.

Board member Tor Ivar Ingebrigtsen (He/him) (1974) was elected to the company's board as an employee representative in 2024. He has been employed at Lerøy Aurora since 2007, where he has worked as an aquaculture technician and later as a site team leader. Ingebrigtsen holds a vocational certificate in aquaculture and is the group union representative for LSG Farming. Additionally, he represents LSG Farming in the wage and industry council. Tor Ivar Ingebrigtsen is also a board member of both Lerøy Aurora and the Norwegian United Federation of Trade Unions (Fellesforbundet) department 74. As of 31 December 2024, Tor Ivar Ingebrigtsen owned 160 shares in the company.

Board members are continuously acquiring new ESG-related knowledge in order to stay up-to-date with new and existing requirements, latest trends and best practices in the ESG-field. Continuous learning is essential to be able to identify new challenges and opportunities. All of the Board members are participating in various trainings, workshops, conferences and networking arrangements.

The Board has nine members, with a gender distribution of 55% men (five members) and 45% women (four members). All Board members serve in a non-executive capacity. Additionally, three of the Board members represent both employees and non-employees. 33% of the Board members are independent.

The Board's members each bring a wealth of experience from diverse fields. Three of the members have extensive experience in leadership and strategic management within the fish industry as well as accounting, auditing, governance, ESG matters, cybersecurity and food safety issues.

The Board of Directors in Lerøy sets the strategic direction for the Group, ensuring that it aligns with the Group's vision and long-term goals. The Board oversees the Group management team, ensuring that they operate effectively and in the best interests of shareholders. It is responsible for identifying and managing risks that could impact the organisation. This involves establishing risk management policies and monitoring their implementation. The Board ensures that the Group adheres to legal and ethical standards. This includes maintaining transparency, accountability, and integrity in all business practices. It also oversees the Group's ESG initiatives, ensuring that the Group has sound ESG practices in place. The Board holds a high-level oversight of Impact, risk and opportunity (IRO) follow-up while the Audit Committee is responsible for ensuring the reporting of IROs.

The CEO has delegated the day-to-day process of identifying and assessing actual and potential impacts on the economy, environment and people as well as the determination of material topics for reporting to the ESG & Quality and the HR departments.

The day-to-day follow-up of sustainability related KPI's is performed locally monthly and quarterly. Annual reviews of reported information are carried out by the ESG & Quality department and the HR department. The Group’s impact on the economy, environment, and people are reviewed by the Group management monthly. The Audit Committee and the Board reviews the same impacts minimum four times a year.

Each member of the Management team is responsible for an area/an operational segment. This includes responsibility for overseeing the Group's impacts on the economy, environment, and people. All companies in the Group have defined sustainability (ESG) related KPIs and these are managed on a local level.

Day-to-day follow-up of sustainability related KPIs is performed locally. Monthly/ quarterly/ annual review of reported information is carried out by ESG & Quality department. Group’s impacts on the economy, environment, and people are reviewed by the Management Team monthly. The Board is reviewing impacts related to economy, environment, and people at every meeting. The Audit Committee is reviewing impacts on the economy, environment, and people in detail four times a year.

Both the Board and the Management Team review and approve both the list of material topics as well as reported information. The material topics and reported information (on high-level) is presented to and approved by the Board. The information is presented and distributed to the Board by the Head of ESG & Quality. The presented information is being reviewed by the Board prior to it being approved. Corrections and amendments are made if necessary.

The Group has developed a Board of Director's Guidance and Working procedure. The document is prepared in cooperation with both the Board and the Chair of the Board. The procedure contains, among other matters, guidance on how the Board and the Management team shall handle agreements with related parties.

The Group has established a procedure to ensure that both the Board and the Management Team must notify the Board of Directors if Lerøy enters an agreement where a member of the Board or the Management Team might have any significant interest in. In cases where a company which has connections to a Board member performs work for the Board, the independence issue is assessed by the Board. If necessary, appropriate action is taken accordingly.

Should transactions with related parties occur, these shall be documented and executed according to the Arm’s Length Principle. An independent assessment shall be carried out for significant contracts. Exemptions may be made for agreements that represent part of the company’s regular operations, and are based on regular commercial conditions and principles.

Agreements with related parties shall be reviewed to ensure sufficient clarity regarding proper balance of the agreements. This is to make sure that the Group is aware of potential conflicts of interest and performs due diligence checks prior to entering a contract. The purpose of this process is to prevent assets being transferred from the company to related parties.

Information on related parties is available in the Group’s Annual report – Financial information – Note G4.7 - Related Parties.

(Potential) conflicts of interest are not disclosed to stakeholders.

When recruiting board members, the Group’s owners follow a longstanding strategy of assessing its need for varied competency (including ESG-related competency), continuity, renewal and changes in ownership structure. It will always be in the Group’s interests to ensure that the composition of the Board varies in line with the demands and expectations made on the Group.

The Board is performing self-evaluation at least annually. The Board’s evaluation of its own performance and of Group management must be seen in conjunction with the Group’s performance. To date, the Board has not issued reports on its evaluation of its own work; this is a conscious priority decision and must be viewed in connection with other announcements in the company’s communications to the public. Moreover, external evaluations of the Board’s work are probably the most influential and are likely to remain so in the future.

If relevant and necessary - actions might be taken in response to these evaluations. The actions can include changes to the composition of the highest governance body and organisational practices.

Recommendations for remuneration of the members of the Board are developed by the company’s Nomination Committee and adopted by the annual General meeting in accordance with section 6-10 of the Public limited Liability Companies Act.

Remuneration of the Board of Directors is not based on results. The Board members elected by the shareholders have no share options. If enterprises which board members are associated with perform work for the company’s Board, the question of independence is treated specifically by the Board.

Remuneration of the Chairperson of the Board and other board members is recommended by the Nomination Committee and adopted by the General meeting.

A renumeration report for executives is published annually, highlighting the actual remuneration, remuneration principles and framework. The guidelines regarding salary and other remuneration shall be clear and understandable and contribute to the company’s business strategy, long-term interests, and financial capacity. The schemes for salary and other remuneration shall help to align the interests of shareholders and executive personnel, and they shall be simple.

The annual general meeting shall, at minimum every four years, review and approve the Board’s guidelines for stipulating salary and other remuneration of persons in senior positions according to the provisions in section 6-16 a of the Public Limited Liability Companies Act and related regulations. Furthermore, the annual General meeting shall hold an advisory vote each year on the Board’s statement regarding paid and current remuneration covered by the guidelines prepared according to section 6-16 a of the Public Limited Liability Companies Act, cf. section 6-16 b of the Public Limited Liability Companies Act.

Regarding remuneration of executive personnel – the Company mainly uses fixed pay as a compensation option. Variable pay is used to a limited degree. Executive salary shall be competitive, so that the company is able to attract and retain the most skilled executive-level employees. The fixed remuneration of executive personnel shall include: Base salary – it is established on the basis of the responsibilities, complexity, competencies and length of service for the position.

Base salary is normally the main element of executive personnel salaries. Bonus schemes – in principle, bonuses are a form of profit sharing where members of management are remunerated for their contribution to the company’s long term earnings and development.

The purpose of Lerøy’s bonus scheme is to stimulate continuous development of Lerøy’s value creation, growth and results, as defined in the company’s strategy. Bonus payments are assessed and stipulated every year based on a comprehensive evaluation of five components: the executive’s value creation, efforts, results, values, attitudes and conduct – all in relation to defined goals, tasks and available resources, this also includes performance related to organizations impacts on the economy, environment and people.

At the end of the assessment period, a decision regarding the extent to which the criteria for a bonus payment have been met. The assessment is performed according to the criteria described above. Bonus payments to persons in senior positions may compromise up to one year’s salary. The company does not have a scheme for repaying of variable remuneration. The Board reserves the right to make amendments or terminate the bonus scheme on yearly basis.

The company does not have any scheme for reclaiming variable remuneration. The Board of Directors has the right to make changes to or terminate the bonus scheme on a yearly basis.

Lerøy Seafood Group ASA has a defined contribution pension scheme according to the Act relating to mandatory occupational pensions. The base for premium payments is capped at maximum 12G (G is the national insurance base amount) per year.

Senior executives in the Group are members of the company’s collective pension scheme up to the Group’s in-house retirement age, which is 70, and do not have separate agreements that include early retirement or supplementary pensions. The company may, however, enter into such agreements in the future.

In principle, the company does not make use of severance pay apart from salary during the period of notice for the number of months stipulated in the provisions of the Working Environment Act. Severance pay may, however, be a good alternative in some situations for all parties involved. Severance pay can therefore be utilized in extraordinary circumstances, albeit capped at two annual salaries.

The Board of Lerøy Seafood Group ASA emphasizes the importance of having good corporate governance, which clearly establishes the division of roles between shareholders, the Board and the Group's management. The Board has its own dedicated board member who has special responsibility for the environment and sustainability (ESG related matters).

The goal of Lerøy Seafood Group ASA is that all parts of the Group's value chain will operate and create growth and development. This is in accordance with the Group's strategy for long-term and sustainable value creation for shareholders, customers, suppliers and society as a whole.

The Board of Lerøy Seafood Group ASA has the overall responsibility for sustainability work within the Group.

In the Group, the CEO has main responsibility for this area. Matters related to sustainability are approved by the Group management before they are sent to the audit committee / board. The Head of ESG & Quality is responsible for coordinating work involving the environment/ sustainability for all the companies within the Group. Responsibility is delegated to the Managing Director of each subsidiary.

Managers and other employees, at the various levels in the organization, have different goals related to sustainability included in their job descriptions. The company also works with goal management where goals related to sustainability are included. Goals related to job descriptions and goal achievement are included in the basis for the payment of bonuses.

The company has audited consolidated financial statements on public record. For information regarding the list of entities included in financial reporting, please, visit Lerøy Annual Report 2023.

All reporting entities report relevant ESG data in the reporting system Cemasys which consolidates the information on a Group level. There are no adjustments to information for minority interests as it is not relevant in the given context. If mergers and/or acquisitions occur it is taken account into reporting and the reporting is accordingly adjusted to ensure completeness. The approach does not differ across disclosures in this Standard and/ or across material topics.

An overview over entities included in the organization’s sustainability (ESG) reporting can be found below. A change compared to previous reporting period is that a new reporting entity (Lerøy Ausevoll) is added to ESG reporting. Lerøy Austevoll is an acquisition acquired in 2023.

NB! Lerøy completes reporting for single Farming region (Norway). Scottish Sea Farms (the UK) is not included in Lerøy Seafood Group ASA sustainability (ESG) reporting scope since Lerøy holds 50% of shares of the company.

Lerøy Seafood Group ASA sustainability (ESG) reporting scope includes companies where Lerøy holds more than 50% of shares of a company.

Lerøy's values are open, honest, responsible and creative, and it is crucial for us to have a continuous and open dialogue with all our stakeholders.

Stakeholder engagement is an important building block for success towards the Group’s goal to becoming the most and effective supplier of sustainable seafood. Engagement with stakeholders helps us identify and manage our positive and negative impacts on the environment, social and governance related issues.

The purpose of stakeholder engagement is to ensure that Lerøy amplifies the positive impacts, mitigates the negative impacts, shares knowledge, best practices as well as ensures meaningful engagement with the stakeholders.

Open and honest communication with our stakeholders is essential for best possible cooperation. Stakeholder identification is a part of Lerøy’s materiality assessment process where relevant stakeholders are identified.

Lerøy Seafood Group communicates with its stakeholders via meetings, various reports (such as the annual report, the stock exchange reports, CDP reports etc.), communication in the media, announcements, joint projects, partnerships, websites and social media.

By integrating stakeholder feedback into the Group's strategic planning and business model, the Group aims to foster cooperative and transparent relationship with all its stakeholders, ultimately contributing to the Group's success and sustainability goals.

Find the overview of stakeholder dialogue below.

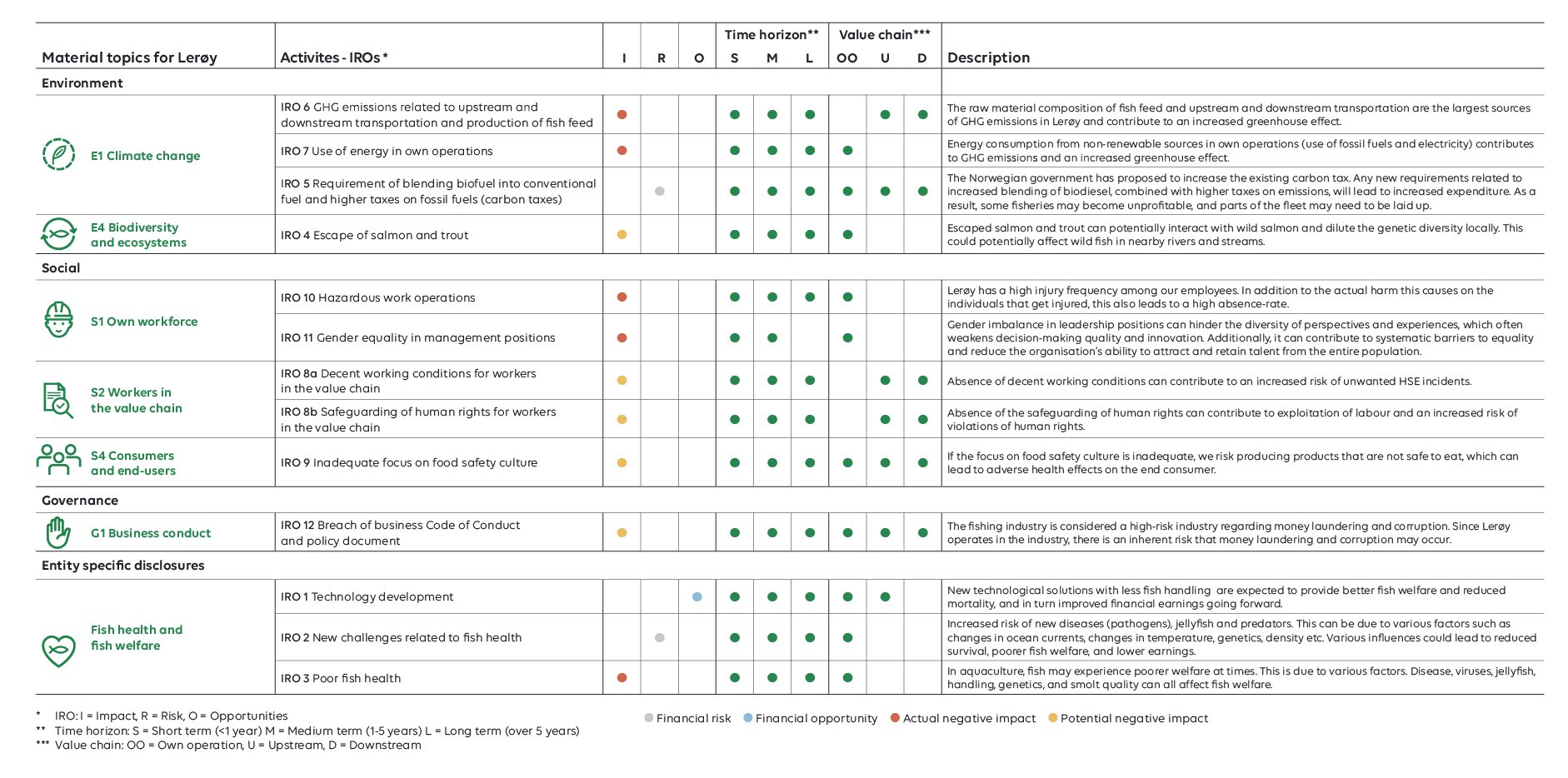

Double materiality assessment (DMA)

2024 was the first year of mandatory reporting pursuant to the EU regulations in the Corporate Sustainability Reporting Directive (CSRD). The basis for the reporting is a double materiality assessment (DMA) which determines the material topics that are the most relevant both from an impact materiality perspective and a financial materiality perspective.

Lerøy used the implementation guidance provided by the European Financial Reporting Advisory Group (EFRAG), which included advice on establishing qualitative and quantitative reporting thresholds. Previous materiality assessments have also been incorporated as inputs into the DMA process. The results of the assessment are to be reviewed annually. The DMA covers the Group’s own operations and the upstream and downstream value chains.

The result of the DMA forms the basis for the sustainability reporting and includes relevant and accurate information about all impacts, risks and opportunities (also referred to as IROs) across the environmental, social and governance matters determined to be material from a double materiality perspective.

Customers drive economic growth by creating demand for goods and services, which in turn leads to job creation and increased economic activity. Customers can have positive environmental impacts by choosing to buy products that are produced sustainably and have a lower carbon footprint. This can lead to increased demand for environmentally friendly products and services, which can drive innovation and investment in low carbon footprint products.

Customer drive has positive social impacts by choosing to buy products that are produced in ways that are fair and ethical, such as those that are produced using fair labor practices or that support local communities

The future development of Lerøy will be determined by our ability to achieve continuous improvements, increased efficiency, innovation and development of sustainable solutions throughout the value chain. To be able to do this we need to cooperate with strategic customers who share the same perspective.

To be able to reach our target to reduce climate emissions with 46% and drive innovation and investment in green technologies, we need to make choises (i.e fish feed ingredients with lower emissions). These choices need to be rooted with our strategic customers, if not , we risk developing products and services which are not demanded in the market and risk to loose value creation for our self, our customer and the society.

Lerøy will, in long term cooperation with strategic customers, develop new product categories which will generate value creation, job creation and riple effects for the local communities.

If we understand and fulfil customer and market opportunities, Lerøy succeeds when our customers succeed. We shall meet our customers’ expectations in terms of delivery, sustainability, quality and costs, and we shall create growth in existing and new markets via forward-looking and innovative sustainable solutions.

Values are created in value chains, and in businesses in value chains, that form a network and competitive processes for their customers.

Our vision “to be the world’s most effective and sustainable value chain for seafood”; requires us to continue to develop in order to achieve a position as a preferred supplier of seafood on a global scale. Our customers aim for growth and new market shares by offering competitive solutions with a view to cost and quality, innovation, security of supply and food safety.

We need to understand the wishes of our customers, and our value chain needs to be built upon competitive processes that ensure success for our customers. Feedback from customers is an opportunity for improvement.

Target: Increase the share of sales revenue from strategic customers

Lerøy has focused on achieving growth by means of securing access to raw materials that are fully traceable and governable. Lerøy's value chain comprises a large product range and allows for development of activities and products to increase customer satisfaction and willingness to pay, which in turn helps our customers gain new market shares.

The fundamental principles in the method utilised to achieve our goals are working continuously to achieve optimal flow of goods to the customer and optimal flow of information from the customer, by means of continuous improvement. This requires a decentralised organisation that is able to solve problems where and when they emerge, but also a Group that has the capacity to disseminate information from customers back to the value chain, so that all parties are aware of the challenges to be solved. Problem-solving shall be based on facts.

Lerøy has not been involved in any negative impacts through its activities or as a result of our business relationships related to customer perspective.

The Group works actively to build long-term, strategic customer relationships in which values for both parties are created over time. Strategic customers are customers considered important to the long-term sucess of Lerøy, with the same values, goals and with mutual beneficial sustainable outcomes. Strategic customers may have an uniqe requirement or needs that are diffcult for other companies to fulfill.

The Group has and shall have a wide range of customers in order to minimise risk related to individual customers. The share of revenue from strategic customers, is used as an indicator of our performance in this area.

In 2024, 61% of our revenue came from strategic customer, close to target. We have been in dialogue with several strategic customers and defined strategic long term partnerships.

To define partnership models with long term beneficial outcomes takes time, our ambition is that 70% of our revenue share comes from strategic customers within 2030.

|

|

Target 2024 |

2024 |

2023 |

2022 |

|

Share of revenue from strategic customers (%) |

48 |

61 |

54 |

50 |

All 198 member nations of the UN have participated in the preparation of the 17 sustainability goals. The Group has selected the goals that are most relevant to our businesses, which we will work towards in our daily activities and focus on in the Group's strategy work.

Lerøy is a member of numerous industry and trade groups, and partners with various non-profit organisations and non-governmental organisations, both at local, national, and international levels.

This includes organisations that represent the seafood industry, food industry, and the business community on issues that are important to our stakeholders.

We provide information directly to stakeholders or through our memberships of trade or policy-focused organisations. Such policy engagement and political activities must always comply with Lerøy’s Code of Conduct and all applicable laws.

With its catch of whitefish and the production of Atlantic salmon and trout, the Group is a globally competitive and sustainable food producer. The Group performs its sustainability reporting in accordance with the CSRD framework, which is part of the Group's annual report. Data from the Group's sustainability reporting is used by several organisations to assess Lerøy's performance on environmental, social, and governance (ESG) issues.

One such organisation is Coller FAIRR, which annually publishes its Protein Producer Index.The index was established in 2018 to address the knowledge gap in the ESG risks associated with the food sector. It assesses 60 of the largest listed global meat, dairy, and aquaculture companies on ten ESG factors.

Lerøy's focus and work on ESG is reflected in the index's results, and it was rated the 2nd best performing company both in 2023 and 2024.

In 2022 Lerøy and other Norwegian seafood producers are banned from Russia. This was initiated in August 2014 when Russia decided to ban the import of Norwegian seafood in response to sanctions imposed by the US, the EU and others for the annexation of Crimea and later war in Ukraine.

Sanctions adopted by the EU are implemented in Norwegian law on the basis of the Sanctions Act. Violation of the Sanctions Act is punishable and can result in a corporate penalty, Lerøy does not have any trade with Russia.

Since the Russian ban origin from 2014, the economical impact is low. Lerøy have no possibility to mitigate or avoid such bans.

In General Lerøy comply with all regulation of the importing countries to avoid marked bans.

The Group´s product development department cooperates with production and sales to create new products and improve the quality of the existing products through the entire value chain.

At Lerøy, we believe in the power of collaboration to drive innovation and sustainability. Our Product Development Department works in conjunction with a broader team of product developers across our downstream operations, all working together in a “One Lerøy” manner.

The “One Lerøy Product Development Team” works through the entire value chain, from raw materials to finished products in stores, constantly developing new products and improving the quality of existing ones, with a strong focus on utilizing the whole fish for human consumption to reduce food waste.

By utilizing local expertise and pooling our knowledge in our “One Lerøy Product Development Team” we can create a more diverse and inclusive product development process that prioritizes sustainability and meets the evolving needs of our customers. Our shared commitment to Lerøy's values of openness, honesty, responsibility, and innovation helps us to build an inclusive and engaging work environment that fosters creativity and continuous development.

The Product Development Department in Lerøy places a strong emphasis on developing new and innovative products that meet the evolving needs of our customers, while prioritizing sustainability, with a focus on natural ingredients and low salt content, to give consumers a better and more healthy way of eating.

The department follows an "Outside – In" development model that emphasizes sustainability and user-led innovation. This approach involves understanding the insights of the external environment, such as climate, politics, income, population, competitors, and other industries. We use these insights to put together models like the 'Gear Model' and the 'Business Model Canvas,' and then use simulations with tools like drawings, Lego blocks and pretotyping.

Pretotyping involves creating simple product samples and testing them to validate our ideas. This allows us to get quick responses to quick solutions and identify potential challenges or opportunities early in the process. This can be done both in our test kitchen in our main office in Bergen or in one of our many factories. Then we invite users to provide feedback on the product samples we create.

Our commitment to sustainability extends to our packaging as well. We aim to avoid over-packaging*, and to use sustainable materials whenever possible. We believe that sustainability is key to our success, and we strive to ensure that every aspect of our operations is as sustainable as possible.

Our packaging strategy is aligned with our goal to reduce food waste, prolong shelf life and product quality while having the lowest possible eco footprint. We are working towards a sustainable packaging material portfolio by 2030, using materials that can either be recycled, reused or are biodegradable.

To achieve our sustainability goals, we have established a category team for packaging, comprising people from different departments with diverse knowledge and experience. The team works closely with our own companies, suppliers, and producers, as well as other aquaculture companies and NGOs to ensure that the best packaging solutions are used.

*Over-Packaging describes a product that is wrapped in multiple layers of materials, that is either unnecessary or unwanted by the consumer.

In addition to our focus on waste reduction we are also exploring the use of complementary products like algae that will help to increase the sustainability of our core products such as shellfish and white fish. Our goal is to create a range of complementary products that will add value to our core products and enhance their sustainability.

Food safety is another top priority for us. We work closely with our suppliers to ensure that our products meet or exceed industry standards for safety and quality. We are constantly reviewing our processes to ensure that we are using the most effective and sustainable methods available.

The Product Development Department in Lerøy believe that sustainability is not just an obligation, it's an opportunity. By prioritizing sustainability in our product development process, we can create products that are not only better for the environment but also more appealing to consumers.

We are proud to be at the forefront of sustainable seafood development, and we look forward to continuing to develop innovative, sustainable products that meet the needs of our customers and the world around us.

| 2024 | 2023 | 2022 | |

| Employees | |||

| Employees, total (number) | 6194 | 6013 | 5972 |

| Employees, own (number) | 5311 | 5342 | 5119 |

| Employees, hired (number) | 883 | 671 | 853 |

| Employees, women (number) | 2418 | 2333 | 2331 |

| Employees, men (number) | 3776 | 3680 | 3641 |

| Temporary employees (number) | 492 | 768 | 747 |

| Part-time employees (number) | 559 | 757 | 783 |

| Managers in the Group with responsibility for personnel (number) | 515 | 502 | 460 |

| Managers, women (%) | 24 | 25.10 | 29.10 |

| Managers, men (%) | 76 | 74.90 | 70.90 |

| Employees with occupational injury insurance (%) | 100.00 | 100.00 | |

| Members of trade unions (number) ** | 2244 | 1564 | 1664 |

| Employees covered by collective bargaining agreement, own (%) | 75 | 70.93 | 67.51 |

| *) This number provides an overview of those who have actively chosen to share information on whether they are a member of a trade union. Some national legislations prohibit employers from asking whether an employee is in a trade union. | |||

| Employees covered by collective bargaining agreement, own – Norway (%) | 71 | 67.61 | 67.84 |

| Employees covered by collective bargaining agreement, own – International (%) | 80 | 79.12 | 66.83 |

| Employees with employment contract (%) | 100 | 100 | |

| Response rate on employee survey from Great Place to Work (%) | 87 | 82 | 86 |

| Training and further education | |||

| Employees who have received training in business ethics (%) | 100 | 100 | |

| Managers in the Group that have completed Lerøy Leadership Program | 84 | 79 | 108 |

| Apprentices (number) | 170 | 146 | 156 |

| Trainees (number) | 22 | 25 | 18 |

| Internships (number) | 102 | 163 | 99 |

| Certificate of apprenticeship achieved with employer (number) | 86 | 78 | 83 |

| HSE | |||

| Sick leave (%) | 5.9 | 6.04 | 6.68 |

| Short-term sick leave (%) | 2.2 | 2.35 | 2.98 |

| Long-term sick leave (%) | 3.7 | 3.69 | 3.70 |

| H1/LTIFR value | 14.26 | 18.73 | 13.31 |

| Injuries with absence (number) | 132 | 172 | 118 |

| Injuries without absence (number) | 133 | 93 | 63 |

| Near misses (number) | 915 | 1041 | 1001 |

| Safety observations (number) | 9865 | 6940 | 5289 |

| Reported near misses per man years, RUI (number) | 2.3 | 1.60 | 1.20 |

| Fatal accidents (number) | 0 | 0 | 0 |

| Companies with employee representatives on working environment committee (%) | 71.4 | 73.33 | 65.52 |

| Risk assessment completed in relation to risk of employees developing antibiotic resistance | Yes | Yes | Yes |

| Social Responsibility | |||

| Feedback from stakeholders, positive/negative (number) | 18 | 15 | |

| Fines (number) | 3 | 2 | 4 |

| Internal whistleblowing cases (number) | 9 | 17 | |

| Cases involving harassment (number) | 3 | 13 | |

| Cases involving sexual harassment (number) | 2 | 2 | |

| Cases involving breach of CoC / Policies (number) | 4 | 2 | |

| External whistleblowing cases (involving harassment number) | 1 | 3 | |

| Inquiries related to access, related to the Norwegian Transparency Act | 3 | 5 | |

| New suppliers that were screened using environmental criteria (%) | 37 | 16.73 | 14 |

| New suppliers that were screened using social criteria (%) | 37 | 16.73 | 14 |

| Audits, supplier (number) | 62 | 66 | 50 |

| Audits, internal (number)* | 979 | 973 | 921 |

| Non-approved supplier audits (number) | 0 | 2 | 0 |

| Product recalls (number) | 7 | 3 | 11 |

| Number of product processing factories with GFSI certification (%) | 93 | 92 | |

| Markets without market access (number) | 1 | 1 | |

| Total tax contributions from the Group and the employees (NOK million) | 1462 | 1463 | 1138 |

| Purchases in Norway, excl. intragroup purchases (NOK billion) | 18 | 19.9 | 18.9 |

| Suppliers in Norway (number) | 5142 | 5404 | 5137 |

| Municipalities in Norway in which purchases have been made (number) | 248 | 247 | 299 |

| Participation in collaborative groups for aquaculture | Yes | Yes | Yes |

| Participation in collaborative fora for fisheries | Yes | Yes | Yes |

| Support for humanitarian organisations | Yes | Yes | Yes |

| *) Audits related to various schemes, agencies and internal resources | |||

| 2024 | 2023 | 2022 | |

| Survival | |||

| Survival in sea (%) | 93.1 | 91.5 | 92.5 |

| Survival on land (%) | 94.5 | 91.3 | 91.4 |

| Antibiotics | |||

| Antibiotics used in sea (kg active substance) | 219 | 0 | 0 |

| Antibiotics used on shore (kg active substance) | 0 | 0 | 0 |

| Top 6 disease that has caused mortality (number of million fish/biomass tonnes) | |||

| Bacterial wounds (number of million fish/biomass tonnes) | 1,8/ 3 934 | 2.2/4 346 | 10/2 666 |

| Unspecified (number of million fish/biomass tonnes) | 1.0 / 202 | 1.1/2 128 | - |

| Treatments (number of million fish/biomass tonnes) | 0.9 / 2 253 | 1.1/2 544 | 1.3/3 296 |

| Viral disease (number of million fish/biomass tonnes) | 0.7 / 2 422 | - | - |

| Gill infection (number of million fish/biorross tonnes) | 0.5 / 1594 | 1.7/4 385 | |

| Handling (number of million fish/biomass tonnes) | 0.3 / 2002 | - | - |

| Lice | |||

| Average number of fully grown lice per fish in LSC Farming (number) | 0.22 | 0.18 | 0.18 |

| Cages treated for lice (number) | 1463 | 1772 | 1853 |

| Volume Of delousing agents used via feed (kg active substance) | |||

| Slice | 16.6 | 9.09 | 8.27 |

| Volume Of delousing agents used via bath(kg active substance) | 26 625.6 | ||

| Alpha max | 0 | 0 | 1.42 |

| Azasure | 0 | 0 | 0 |

| Salmosan | 53.3 | 66.5 | 44.50 |

| Ectosan | 1153 | 3131.0 | 1507 |

| Hydrogen peroxide | 0 | 23482.2 | 0 |

LICE

| Average number of fully grown lice per fish per company | 2024 | 2023 | 2022 | |||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | |

| Lerøy Aurora | 0,15 | 0,10 | 0,20 | 0,23 | 0,11 | 0,06 | 0,06 | 0,11 | 0,12 | 0,05 | 0,04 | 0,07 |

| Lerøy Midt | 0,19 | 0,09 | 0,38 | 0,21 | 0,13 | 0,13 | 0,28 | 0,26 | 0,16 | 0,16 | 0,27 | 0,26 |

| Lerøy Sjøtroll | 0,16 | 0,13 | 0,36 | 0,33 | 0,17 | 0,14 | 0,23 | 0,21 | 0,2 | 0,13 | 0,25 | 0,24 |

| LSG Farming | 0,17 | 0,22 | 0,33 | 0,27 | 0,15 | 0,12 | 0,19 | 0,27 | 0,17 | 0,12 | 0,22 | 0,21 |

-

| 2024 | 2023 | 2022 | |

| Biodiversity | |||

| Escapes of fish (number) | 13732 | 15030 | 10544 |

| Rømt laks | 13478 | ||

| Rømt ørret | 254 | ||

| Average density, per cage (kg/m3) | 7.68 | 7.70 | 8.0 |

| Average fallow period (number of days) | 141 | 136 | 167 |

| Average MOM B score | 1.27 | 1.32 | 1.38 |

| Percentage of localities with GLOBALG.A.P./ASC certificate for farming (%) | 100 | 100 | 100 |

| Localities taking part in zone collaboration (%) | 100 | 100 | 100 |

| Fish Feed | |||

| FFDRm, salmon | 0.58 | 0.58 | 0.53 |

| FFDRo, salmon | 1.68 | 1.52 | 1.60 |

| Marine raw materials/vegetable raw materials (%) | 27/37 | 31/69 | 29/71 |

| ProTerra certificate soy (%) | 98.9 | 83 | 100 |

| Traceable soy in value chain (%) | 100 | 100 | 100 |

| Share of deforestation-free soy protein concentrate from Brazil with traceability (%) | 100 | 100 | 100 |

| Total certified raw materials (%) | 41 | 48.00 | 42.00 |

| Marine raw materials certified (MSC+IFFO/Marine trust including FIP) (%) | 100 | 97.00 | 94.60 |

| Wild Catch | |||

| MSC-certified marine species caught (%) | 96 | 91 | 95 |

| Water | |||

| Water withdrawal LSG (m3) | 91 629 591.3 | 88 423 891.8 | 96 775 397 |

| Water discharge LSG (m3) | 91 577 501.5 | 88 368 527.3 | 96 630 139 |

| Consumed water LSG (m3) | 52451 | 55 364.5 | 145 258 |

| Consumed water in water stressed areas | 16965 | 10 833 | 3 023 |

| Waste | |||

| Food waste industry: reduction in fish on floor and unsold products (kg) | 329 126 | 307 771 | 293 893 |

| Food waste wildcatch – increased production of meal, il and ensilage (kg) | 5 185 050 | 5 332 280 | 4 840 000 |

| Non-organic waste, recycled, reused or material recovered (%) | 44.33 | 44.96 | 47.25 |

| Plastic consumption | |||

| Volume of plastic purchased (kg) | 9 642 719 | 7 964 812 | 8 392 168 |

| Climate – GHG | |||

| Scope 1 (tCO2e)* | 156 638 | 168 064 | 169 912 |

| Scope 2 (tCO2e) (location based) | 8 210 | 8 821 | 7 240 |

| Scope 3 (tCO2e) | 1 728 841 | 1 704 629 | 1 640 179 |

| SUM Scope 1,2 and 3 (location based) | 1 893 688 | 1 881 514 | 1 817 331 |

| Scope 2 (tCO2e) (market based) | 99 862 | 86 428 | 65 028 |

| Biogenic emissions from Scope 1 (tCO2e) | 7 270 | 1 290 | - |

| Biogenic emissions from Scope 3 (tCO2e) | 0 | 0 | - |

| Transport | |||

| Transported by road (%) | 11 | 53 | 79 |

| Transported by sea (%) | 1 | 19 | 12 |

| Transported by air (%) | 88 | 29 | 9 |

| Breaches of legislation and regulations related to the environment (%) | 0 | 0 | 0 |

| *) Description of methodology used and assumptions made in developing the greenhouse gas statements[AL1] can be found at https://www.leroyseafood.com/en/sustainability/sustainability-library-2024/climate/ | |||

| Whistleblowing cases | 2024 | 2023 | 2022 |

| Number Reported cases/ Confirmed cases | Number Reported cases/ Confirmed cases | Number Reported cases/ Confirmed cases | |

| Health and Safety | 9/0 | 5/1 | 14/1 |

| Workers rights | 1/0 | 0/0 | 0/0 |

| CoC/policies | 8/2 | 3/0 | 2/0 |

| Corruption | 0/0 | 1/0 | 1/0 |

| Environment | 0/0 | 0/0 | |

| Suppliers | 0/0 | 0/0 | |

| Customers | 0/0 | 0/0 | |

| Total | 18/2 | 9/1 | 17/1 |