-

SEARCH

Type your search in the field above

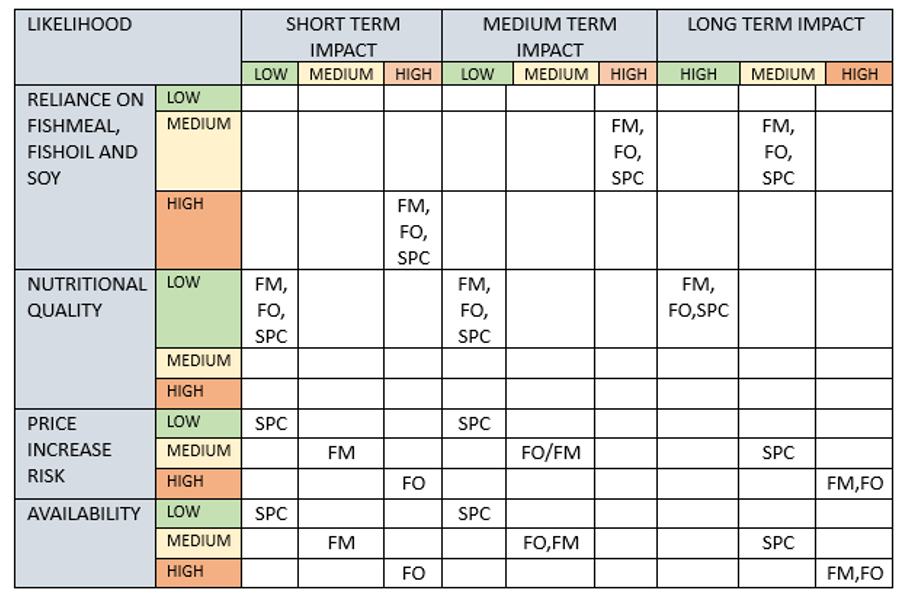

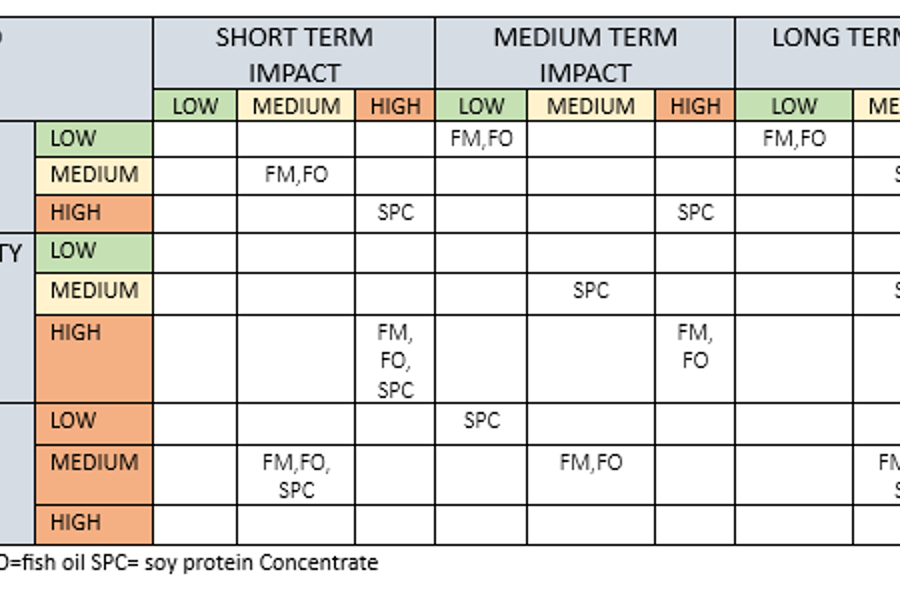

Lerøy's risk assessment to identify material risks posed by the dependence on fishmeal, fish oil and soy, on short (2025), medium (2030) and long term (>2030) impact. The impact and likelihood assessment is based on consultations with Lerøys internal resources from Quality & ESG, R & D and procurement department, feed supplier information, public reports from FAO, IFFO, “Råvareløftet”, Sintef, Marine trust, and MSC.

Lerøy purchase certified SPC from companies that holds an deforestation free value chain, but indirectly contributes to deforestation and GHG emissions. In short and medium term SPC pose a high impact on climate change, but in long term reduced land use change (LUC) and shift towards regenerative agriculture expect to improve emissions to medium impact.

For FM and FO the main impacts comes from fossil fuels, and pose a medium impact in short term. For long term impact we expect a shift towards utilization of renewable energy, thereby reducing the impact to low.

The total effect of production and processing of marine raw material on biodiversity and ecosystems is complex, and we believe that standardization and certification of sustainably sourced raw materials will play an crucial role on mitigation of negative effects on biodiversity.

Production of SPC has challenges with use of pesticides, monoculture with forest conversation, posing a high impact in short term. However, with increased implementation of regenerative agriculture we expect the medium and long term impact to be reduced to medium impact.

The value chain of raw materials for feed might have social and political effects. To mitigate negative effects we have an strategy to only purchase certified SPC and marine ingredients. Public opinion is still challenging utilization of certified SPC in feed, but with lower emissions due to reduction of LUC and switch to European and US produced SPC, we except low regulatory impact in medium term , but medium impact in long term due to competition with protein sourcing for human nutrition. Marine ingredients from FM and FO medium impact due to pressure on fisheries, and we expect the global demand for marine ingredients to increase with stagnant supply.

In short and medium term, we have an high impact with high reliance on SPC due to good nutritional value, availability and low prices. Over time we expect pressure on protein sources, and in long term the reliance on SPC is mitigated with new alternative protein sources, reducing our reliance on SPC to medium impact. In short and medium term, we have an high impact due to our reliance on FM and FO. There are no good replacements for FM and FO now, but going forward nutritional knowledge and diversification with alternative raw materials will reduce the reliance on FM and FO to medium impact.

Low impact means current and future nutritional profile of FM, FO and SPC matches and is expected to continue to match the nutritional needs of the fish. Medium impact means nutritional profile of feed raw material can change leading to worse fish performance/quality/welfare. High impact means nutritional profile of raw material does not match nutritional needs of the fish. We do not expect an change in the nutritional quality for FM, FO or SPC, in short, medium or long term.

Low impact means stable and predictable prices, medium impact means prices are subject to increase but alternatives are available and high impact means prices can increase quickly and significantly with no alternatives and are influenced by outside-the-market forces. For SPC we expect stable prices short and medium term, but due to increased pressure on protein sources we expect higher prices in the future, which pose a medium impact. FM is currently following protein market, therefore we except higher prices due to pressure on fisheries. FO currently experience acute supply shortage, and we expect an normalisation medium term, but limited supply going long term.